capital gains tax indonesia

Capital gains are generally assessable together with ordinary income and subject to tax at the standard CIT rate. However there are several exemptions.

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn

If you decide to sell youd now have 14 in realized capital gains.

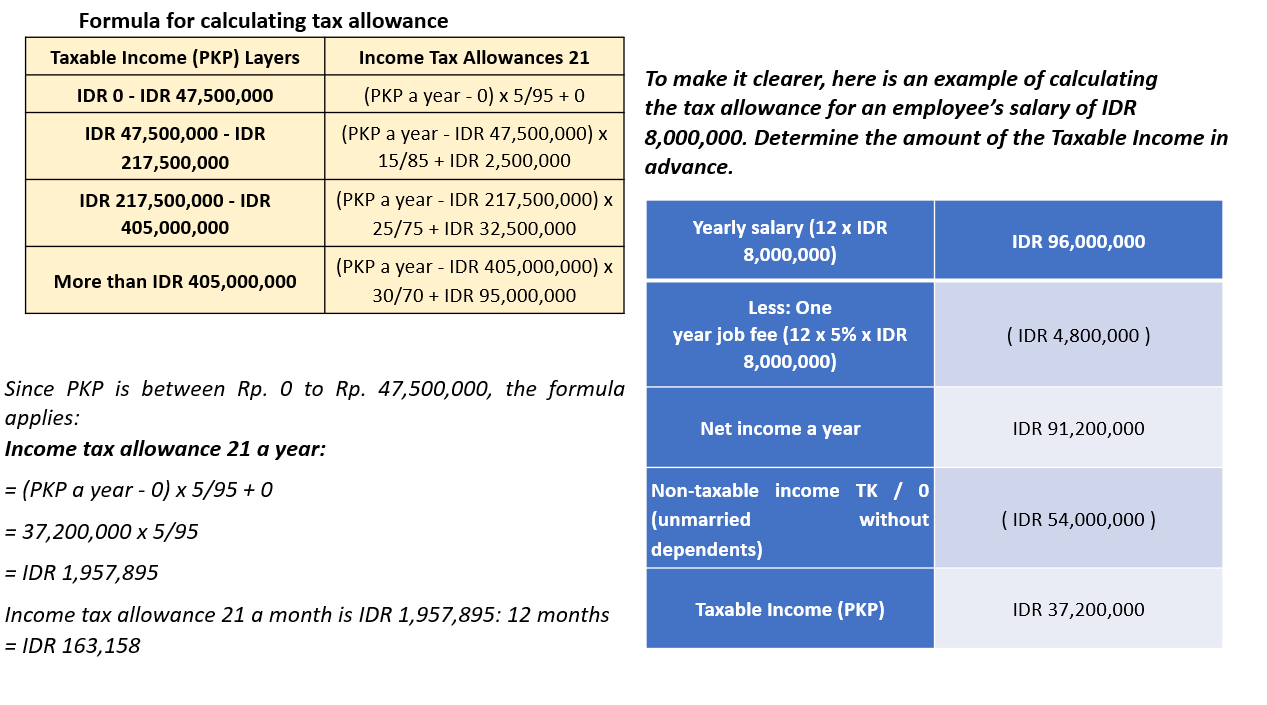

. The amount taxed for capital gains depends on the income of the taxpayer and their filing status. In general a corporate income tax rate of 25 percent applies in Indonesia. A tax resident is generally taxed on worldwide income although this may be mitigated by the application of double taxation agreements DTAs.

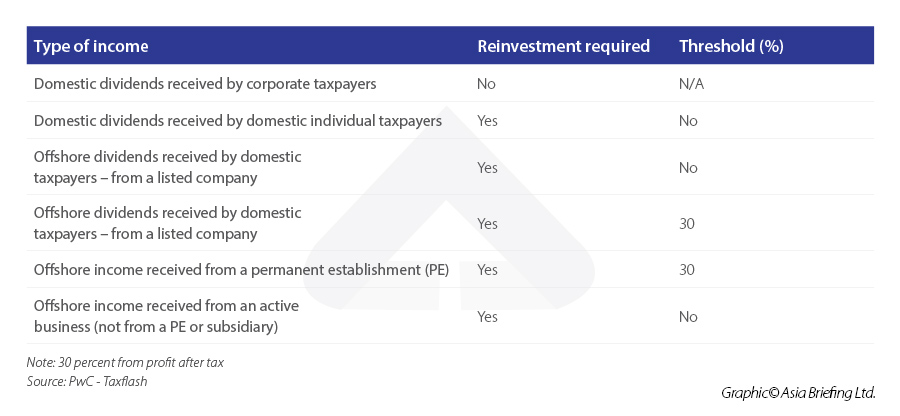

However gains from the transfer of land and buildings are not. Share deal Capital gains received by an entity in a share deal are. The sale of shares listed on the Indonesian stock exchange is subject to a final tax at 01 percent of gross proceeds.

Gains on shares listed in Indonesia are taxed at 01 final tax of the transaction. In arriving at effective capital gains tax rates the Global Property Guide makes the following assumptions. Apabila mengacu pada definisi ini Indonesia telah.

Companies listed on the Indonesia Stock Exchange. In Indonesia the main differences among acquisitions made through a share deal versus an asset deal are as follows. Updating the DTA can further enhance Singapores status as a hub for international investments into Indonesia.

The transfer of titles to land and buildings under an asset. At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains. Indonesia Highlights 2022 Page 2 of 10 Corporate taxation Rates Corporate income tax rate 22 Branch tax rate 22 plus 20 branch profits tax in certain circumstances Capital gains tax.

Indonesia introduced a 01 VAT and capital gains tax on crypto transactions and investments. Indonesia plans to charge value-added tax VAT on crypto transactions and capital gains at a rate of. The Avoidance of Double Tax Agreement DTA between.

Capital gains tax secara umum adalah pajak atas setiap keuntungan yang diperoleh investor atas investasinya. The taxes will come into effect from May 1. Updates to the Avoidance of Double Tax Agreement between Singapore and Indonesia.

There were three significant changes to the tax. The settlement and reporting of the tax due is done on self. Taxes on crypto have been.

For the transfer of unlisted shares 25 capital gain tax due on net basis will apply for the Indonesian tax resident seller. Taxation on Capital Gains and Investment Income Capital gains are generally assessable at standard income tax rates together with other income of the individual. In capital gains tax Indonesia has the right to tax capital.

Capital gains derived by an individual are taxed as ordinary income at the normal rates. The property is directly and jointly owned by. The valued-added and capita-gains taxes will take effect on May 1.

The tax treatment of capital gains would thus be determined by each States domestic tax rules by Article 21. Capital gains taxes. 15 Sep 2021 5 min read.

Most long-term capital gains are taxed at rates of 15 or less.

Are You A Forex Trader Looking To Move To A New Country Or Is Your Country Already One Of The Best Find Out Learn Forex Trading Forex Graphing Calculator

One Of Classic Car Shown At An Exhibition By Indonesian S Iccoc Grand Indonesia Jakarta A Newly Opened Sho Classic Cars Classic Car Insurance Car Insurance

Indonesia Payroll And Tax Guide

The Reason For The Globalisation Of Tech R D The Continental Telegraph Global Japan Economics

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn

Corporate Income Tax In Indonesia Acclime Indonesia

Indonesia Payroll And Tax Guide

Indonesia Considers Plan To Tax Trade In Cryptocurrencies Reuters

What Are The Changes In Tax Treatment Under Indonesia S Omnibus Law

With Its Breathtaking Backdrop Of The Dreamland Pecatu Bali Indonesia This 16 Units Villa And 87 Units Apartments Is In The Perfect Setting For A Special Fam

Indonesia Payroll And Tax Guide

Property In Indonesia Indonesian Real Estate Investment

Corporate Income Tax Rate And Facility Income Tax Capital Gains Tax Filing Taxes

Tax Tips For Homeowners Home Savvy Capital Gains Tax Tax Debt Income Tax Return

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn