interest tax shield calculator

The tax shield on interest is positive when earnings before interest and taxes ie EBIT exceed the. The value of these shields depends on the effective tax rate for the corporation.

Tax Shield Formula Step By Step Calculation With Examples

The taxes saved due to the Interest Expense deductions are the Interest Tax Shield.

. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. We can easily calculate the value of a tax shield. This companys tax savings is equivalent to the interest.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Tax Rate Tax Deductible Expenses1 Add Expenses Remove Expenses Results. An investor can use Excel to build out a model to calculate the net present value of the firm and the present.

Examples of tax shields include deductions for charitable contributions mortgage deductions. Calculating the tax shield can be simplified by using this formula. Tax Shield A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owed.

This small business tool is used to find the tax rate by using interest expenses and depreciation expenses. Interest Tax Shield Example A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. Its 50000 debt load has an interest tax shield of 15000 or.

After-tax benefit or cash inflow calculator. As you will see below the Interest Tax Shield formula is nearly the same as with the. To calculate your tax shield first find the total cost of the deduction for the entire year then multiply that cost by your estimated tax rate.

For instance if a company pays 2000 as interest on a loan. A tax shield refers to deductions taxpayers can take to lower their taxable income. These are the tax benefits derived from the creative structuring of a financial arrangement.

EBIT Earnings Before Interest and Tax EBIT adj Earnings Before Interest and Tax Amount Offset Against Fe. For this we need the sum of taxable expenses and the tax rate. The interest tax shield can be calculated by multiplying the interest amount by the tax rate.

A companys interest payments are tax deductible. A tax shield represents a reduction in income taxes which occurs when tax laws allow an expense such as depreciation or interest as a deduction from taxable income. Such a deductibility in tax is known as.

This gives you a good idea of the tax. Interest Tax Shield 3500 2500 125100 Interest Tax Shield 109375 Interest Tax Shield Formula The calculation of interest tax shield can be obtained by multiplying average. Interest 8000 ie 2000004 Tax Shield 8000 45000 30 15900 So the total tax shied or tax savings available to the company will be 15900 if it purchases the.

Depreciation tax shield calculator. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Interest Tax Shield Interest Expense x Tax Rate Thereby the APV approach allows us to see.

Therefore the calculation of Tax Shield is as follows Tax Shield Formula 10000 18000 2000 40 The Tax Shield will be Tax Shield 12000 Therefore XYZ Ltd enjoyed a Tax. Tax Shield Value of Tax-Deductible Expense x Tax Rate So for instance if you have 1000 in mortgage. FE Financial Expences T Corporate Tax TS Tax Shield Relevance and.

That is the interest expense paid by a company can be subject to tax deductions.

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shields Meaning Importance And More

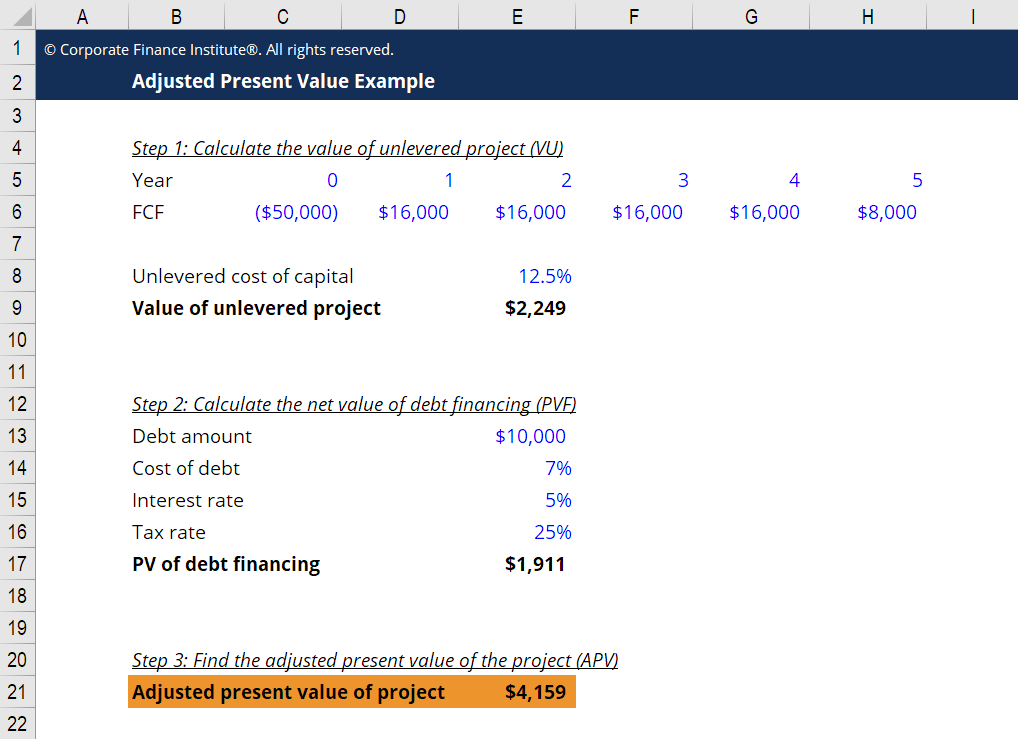

Adjusted Present Value Apv Definition Explanation Examples

Adjusted Present Value Apv Formula And Excel Calculator

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Excel Calculator

Interest Tax Shield Formula And Excel Calculator

Net Operating Profit After Tax Nopat Formula And Excel Calculator

Adjusted Present Value Apv Formula And Excel Calculator

Income Tax Calculator Estimate Your Refund In Seconds For Free

Adjusted Present Value Apv Formula And Excel Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples